trading-options-using-implied-volatility

Trading Options Using Implied Volatility and Standard Deviation

Today, Tom Sosnoff and Tony Battista discuss Implied Volatility and Standard Deviation! These are two very important metrics when trading options and the guys ...

Read more

Implied Volatility | Where Do I Start? Options Trading in 3 Minutes or Less

http://goo.gl/l87d5Q Tom uses Groupon options to show Case what implied volatility is and how to calculate the expected move of GRPN using implied volatility.

Read more

what is implied volatility IV in option trading hindi

in option trading IV is important concept in this lesson.

Read more

Why Implied Volatility Is The Key To Your "Edge" Trading Options - Show #007

http://optionalpha.com/show7 - In this session of The Option Alpha Podcast we're going to have a very advanced conversation about implied volatility (IV) and ...

Read more

Don't Trade Options Blind - Know Your Implied Volatility

The importance of implied volatility to options trading.

Read more

Using Implied Volatility & IV Rank to Trade Options

Learn how you can use Implied Volatility (IV) and IV Rank in order to find option trading opportunities! See the latest tastytrade videos: http://bit.ly/1rYrrVe Implied ...

Read more

How to Trade Implied Volatility: Option Trading, Option Strategies, Stock Trading

www.thestraddletrader.com An option trader pro shows you his newest indicator to find lows in implied volatility. Learn secret strategies to bet up and down at ...

Read more

10. How to Price Options Based on Implied and Historical Volatility

Try a free options trading demo account here: http://bit.ly/Q72dYG For more of our free introductory options course, go here: http://www.informedtrades.com/f115/ ...

Read more

The Foundation Of Making Money Trading Options | Implied Volatility

At the end of the day, the only thing that matters in trading is making money. But, where do we even start? In this episode of the Webinar, Mike Hart and Chris ...

Read more

Using Statistical and Implied Volatility in Trading

Using Statistical and Implied Volatility in Trading Presented by Stanley Dash, Vice-President of Applied Technical Analysis Most traders understand that volatility ...

Read more

Using Implied Volatility to Plan Your Futures Trades

Erich Senft discusses how to use implied volatility to plan your futures trades: There's a little tool I use to help me get an idea which markets are going to be more ...

Read more

Trading Options in Extremely Low Volatility

Find out if extending your duration is a viable strategy to make up for a lack of volatility when Implied Volatility Rank is low! See more trading videos: ...

Read more

A Quick Guide To Understanding Implied Volatility With Examples

http://optionalpha.com - Understanding implied volatility is super easy if you know what you are looking at. In this video I'll show you the difference between ...

Read more

How to Use Option Open Interest and Implied Volatility to Find Trades

View Tek's whole beginner options course: http://www.informedtrades.com/f115/ Practice options trading with a free practice trading account: ...

Read more

How to Model Option Implied Volatility | Trading Data Science

How often do stocks actually fall within expected range? See more options trading videos: http://ow.ly/MZDKN Today, Tom Sosnoff and Tony Battista are joined ...

Read more

The Importance of High Implied Volatility in Small Trading Accounts

Find out what the effect high Implied Volatility has on option spreads! See more tastytrade videos: http://bit.ly/1xTayk2 When selling premium, we always want to ...

Read more

Historical vs. Implied Options Volatility

http://optionalpha.com - The difference between a stock's historical volatility and the implied volatility from options pricing creates our edge as traders because ...

Read more

Using Volatility to Trade Options for Direction 10/23/2014

our Founder discusses how to use implied volatility in directional option trading.

Read more

Historical vs. Implied Volatility

http://optionalpha.com - Understanding how Historical vs. Implied Volatility relates to options trading. ================== Listen to our #1 rated investing ...

Read more

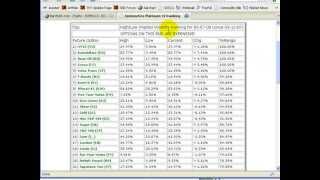

Thinkorswim Implied Volatility Percentile

Is implied volatility high or low? How does it's current value compare to historical values? What happens to implied volatility after an earnings release? Now, for ...

Read more

Using Implied Volatility to Assess Option Strategies

Joseph Cusick, VP of Wealth and Asset Management at MoneyBlock, discusses near-term volatility expectations. Joe analyzes how to implement tactical ...

Read more

Standard Deviation | Options Trading Concepts

Standard Deviation is a quick way to decipher the relationship between implied volatility and the probability of an option expiring ITM or OTM in the options ...

Read more

Proof That Implied Volatility Drops After Stock Earnings

http://optionalpha.com - Before you start making earnings trades it's important to understand the "why" behind what we do. In general, we make earnings trades ...

Read more

Using Implied Volatility to Improve Your Options Trading

How Volatillity Impacts Options Pricing by The Options Industry Council (OIC) For The Full Managing Volatillity Series click here https://goo.gl/0D5Bgv Implied ...

Read more

Implied Volatility IV vs IV Percentile

http://optionalpha.com - Understanding (and mastering) the difference between a stock's actual implied volatility and that IV's percentile or rank going back ...

Read more

Stock Option Volatility - This Will Make or Break Your Profit Potential

http://www.learn-stock-options-trading.com learn how to use option volatility to your advantage. Related text lessons to go with those videos: ...

Read more

IV Rank vs. IV Percentile in Trading | Options Trading Concepts

IV Rank & IV Percentile help us put context around different implied volatility values. Just looking at raw implied volatility is not enough. Tune in to learn the ...

Read more

What Is Implied Volatility? - Part 2 | The Webinar

Learn how to spot option trading opportunities by using implied volatility. If you missed the first part of our explanation of Implied Volatility, check it out here: ...

Read more

Options Strategies for High Implied Volatility

http://optionalpha.com - With the Fed decision today on rates we took advantage of some high volatility trades in the VXX while also positioning for Ford's ...

Read more

Implied Volatility - Options Trading Video 1 part 2

Go to http://www.amazon.com/gp/product/B00JFB3V7O to learn all about implied volatility. Those are my real accounts. They are actual trades that I made.

Read more

What Is Implied Volatility? - Part 1 | The Webinar

Implied volatility is one of the most important things we pay attention to when we're trading. We watch implied volatility to find trading opportunities and ...

Read more

Scanning for Low Implied Volatility Percentile Underlyings Using thinkorswim & Strategy Overview

Learn how to scan for underlying's trading at the low end of their 52-week implied volatility range, and which strategies compliment low IV percentiles. See more ...

Read more

Using Implied Volatility and Expected Move

How to use implied volatility and expected move to determine what will happen next in the markets. https://theotrade.com/total Get Market Cliff Notes delivered to ...

Read more

Implied Volatility Explained | Options Trading Concept

Implied volatility is one of the most important concepts to understand as an options trader. Implied volatility represents the option prices on a particular stock, ...

Read more

Trade Pillar #2: Sell Options in High Implied Volatility | 10 Reasons to be a tastytrader

We've already established that trading liquid products is key to trading success, but once you find a liquid underlying, how do you determine whether you should ...

Read more

Trading Options Using Implied Volatility And Standard Deviation [Option Volatility]

Make Money With ☆IQ Option☆ - The Best Online Broker! Minimum deposit just $10 & Totally Free 1000$ Demo account! ✓Register and Get Best Trading ...

Read more

What is the Difference Between IV Rank & IV Percentile? | Trading Data Science

The tastytrade philosophy tells us to be premium sellers. We emphasize selling high Implied Volatility (IV) and often stress the importance of a high IV Rank (IVR) ...

Read more

Trading Earnings | Implied Volatility Differentials & Using Them To Trade!

https://www.tastytrade.com/tt/ Tom Sosnoff and Tony Battista are analyzing earnings cycles and comparing the front month and back month vol differentials to ...

Read more

Implied volatility | Finance & Capital Markets | Khan Academy

Created by Sal Khan. Missed the previous lesson? Watch here: ...

Read more

Equity Option Implied Volatility Analytics with Python - PyData Singapore

Speaker: Jason Strimpel (@JasonStrimpel) Python has become an increasingly important tool in the domain of quantitative and algorithmic trading and research ...

Read more

Implied Volatility The Double Edged Sword

In this presentation we take a look at Implied Volatility for options investors: 1. What it is - in the simplest terms 2. Difference in Implied Volatility vs. Historical ...

Read more

Talking Volatility: Using Implied Volatility to Assess Strategies – June 24, 2015

Joseph Cusick, VP of Wealth and Asset Management at MoneyBlock, and market volatility expert Jeff Kilburg of KKM Financial discuss near-term volatility ...

Read more

Options Trading: How to Trade Volatility Dispersion

See the latest tastytrade videos: http://bit.ly/1s1L9nu One trade that Tom Sosnoff and Tony Battista have been placing for a long time is known as index arbitrage.

Read more

How to use Implied Volatility for Risk Management in Options Trading

An important risk metric if you are using options trading or option chain for liquidity or forecasting ...

Read more

Options volatility trading on Volcube

Explains the basics of volatility trading via options on Volcube. In this video we execute a couple of simple option trades on Volcube and show how these trades ...

Read more

Keys to help traders understand and use Implied Volatility and IV Rank

http://www.dough.com Here are three keys from dough to help you understand Implied Volatility and IV Rank. Katie & Ryan break down the trading system on ...

Read more

Stefen Choy on Defining Using Implied Volatility to Trade FX Options 1

Why is implied volatility considered one of the most useful of the options Greeks? How does it measure what investors think about future volatility? What ways ...

Read more

Priceline Rallying In Wave 3 With Low Implied Volatility. We're Trading It With Options....

Priceline spent quiet a long time in consolidation setting up the rally that began with today's gap higher. The gap was closed and we're now looking to buy this ...

Read more

![Trading Options Using Implied Volatility And Standard Deviation [Option Volatility]](https://i.ytimg.com/vi/is_mK31-PhA/mqdefault.jpg)