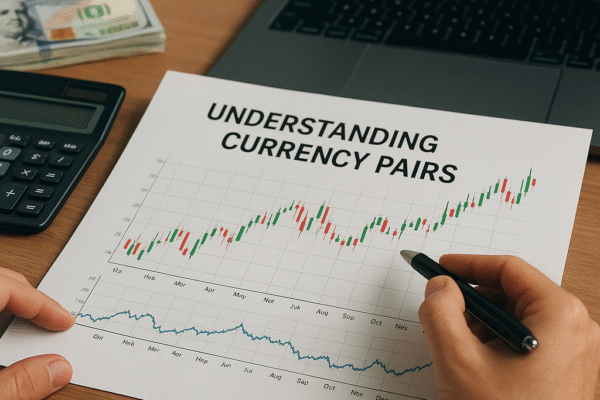

Understanding Currency Pairs: What Every Investor Should Know

The foreign exchange market, often referred to as Forex, is the largest financial market in the world. It allows investors to trade one currency for another, enabling international trade, travel, and global investment. For those looking to expand their portfolio beyond traditional stocks and bonds, currency trading offers a unique set of opportunities and challenges….