How to Choose Between Forex Trading and Currency ETFs

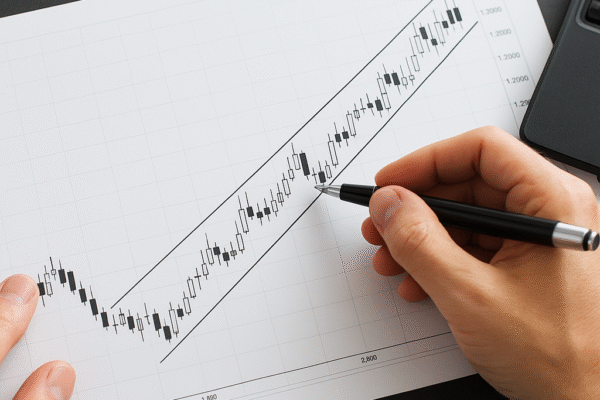

Selecting between Forex trading and currency ETFs demands a clear understanding of how each instrument operates and aligns with your financial goals. Both avenues offer unique opportunities to profit from fluctuations in global exchange rates, but they differ significantly in terms of structure, accessibility, and risk profile. This article explores the essentials of Forex trading…