The Relationship Between Inflation Rates and Currency Strength

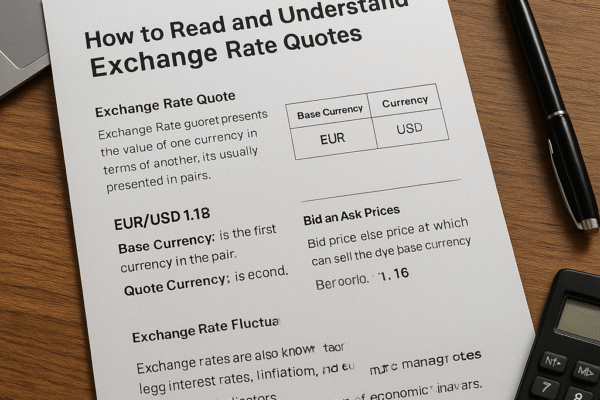

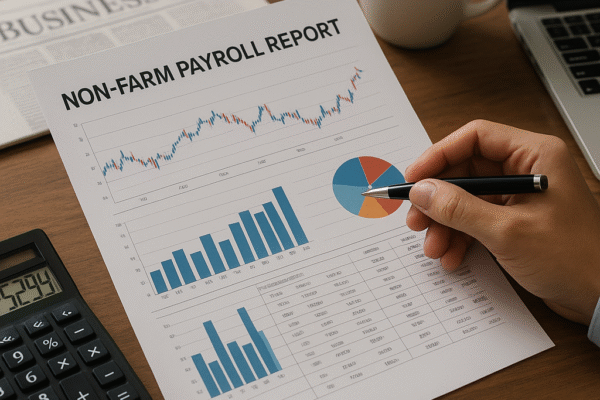

Investors in the foreign exchange market often face a complex interplay between macroeconomic indicators and market sentiment. Among these indicators, inflation rates stand out as a critical driver of currency valuation and investor behavior. This article explores the multifaceted relationship between inflation and currency performance, outlines the key mechanisms at work, and offers practical guidance…