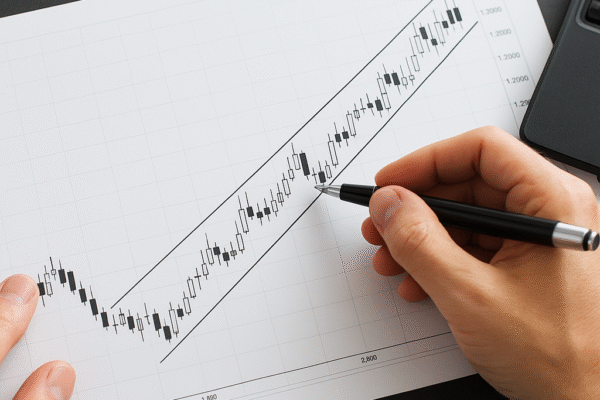

How to Use Moving Averages in Forex Analysis

Moving averages stand out as one of the most accessible yet powerful tools for currency investors seeking to identify trends and market dynamics. Their simplicity hides a depth of versatility: from smoothing erratic price movements to generating clear signals for entry and exit points. This article explores how to harness moving averages effectively in the…