Navigating the world of currency markets demands a clear grasp of how prices are quoted. Each quote represents the value of one nation’s money in terms of another, a concept that can appear daunting at first. By mastering the fundamentals of exchange rate presentation, identifying the key factors that influence currency values, and applying this knowledge in practical scenarios, investors and traders can make more informed decisions. This article will guide you through the core principles of reading and interpreting exchange rate quotes, from basic terminology to advanced trading techniques.

How Exchange Rate Quotes Are Presented

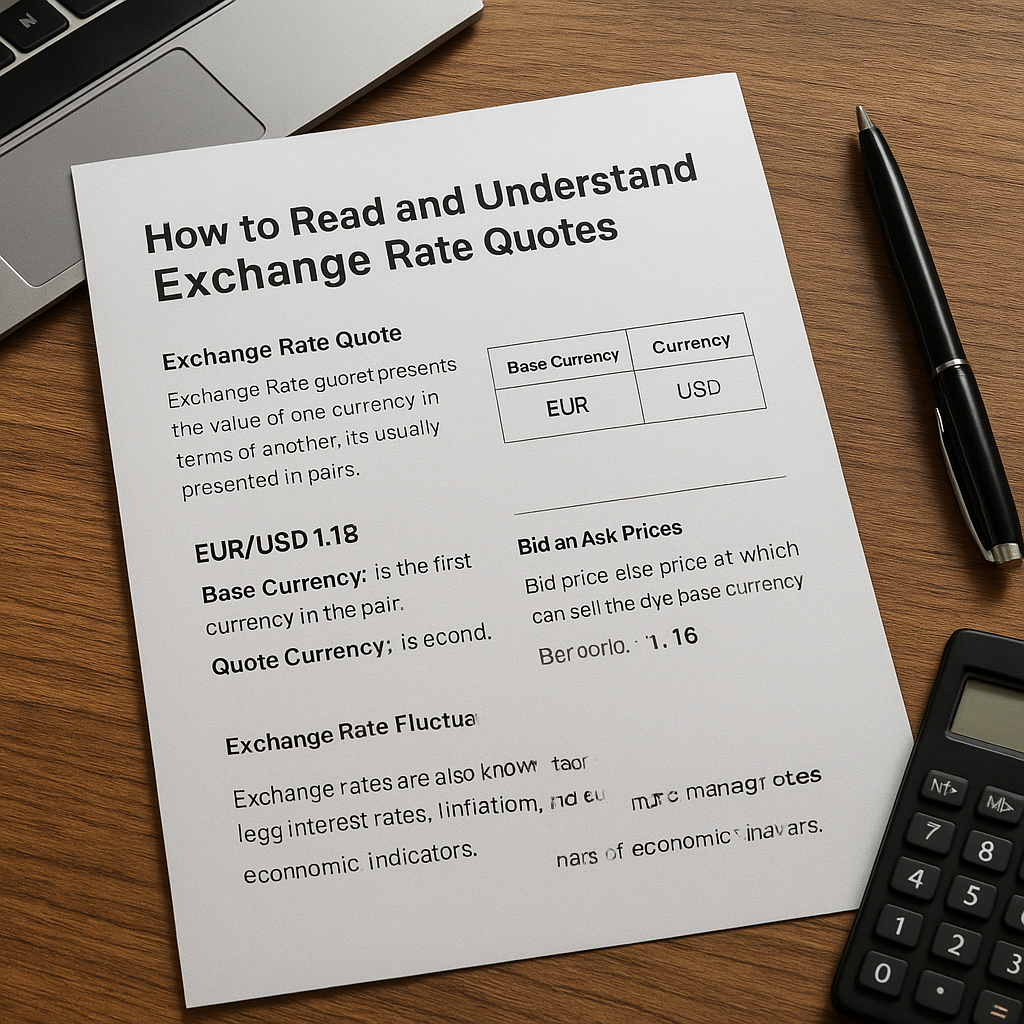

Every currency quote consists of two parts: a base currency and a quote currency. The format “EUR/USD 1.1800” means that one euro (EUR) is worth 1.1800 US dollars (USD). The first currency listed is always the base, and the second is the quote. If the number rises, it takes more USD to buy one EUR, indicating EUR strength or USD weakness. Understanding which side of the pair you are long or short informs your profit or loss when rates move.

Quotes are typically expressed to four decimal places, and the smallest price increment is called a pip. For most major pairs, one pip equals 0.0001. When the EUR/USD moves from 1.1800 to 1.1825, it has gained 25 pips. Traders often watch spreads—the difference between the bid and ask price—which represent transaction costs. A tight spread can reduce trading expenses, while a wide spread increases the cost of entering and exiting positions.

Beyond the basic notation, certain exotic pairs may quote to only two decimal places, and cryptocurrency or emerging-market pairs can vary further. Always confirm the precision and tick size on your trading platform. Also, some brokers express prices in pips and fractional pips (sometimes called pipettes), adding a fifth decimal for finer granularity. Paying attention to these details ensures you understand trade confirmations and margin requirements correctly.

Key Drivers Behind Currency Movements

Currency values fluctuate due to a blend of economic, political, and market-based influences. Central bank policies play a pivotal role: interest rate decisions and quantitative easing programs can alter investor expectations. For example, when a central bank raises rates, that currency may attract capital seeking higher yield, boosting its value. Conversely, expansionary monetary policy can weaken a currency by increasing money supply and lowering returns.

Economic indicators like GDP growth, inflation, and employment figures are also critical. Strong data often lead investors to reallocate funds toward those economies, increasing demand for their currencies. Geopolitical events—elections, trade tensions, or conflicts—introduce uncertainty and can trigger sharp moves. Such events often heighten volatility, prompting risk-averse participants to seek safe-haven currencies like the Japanese yen or Swiss franc.

Market sentiment and technical analysis further influence short-term price action. Traders monitor chart patterns, moving averages, and oscillators to identify trends and reversal points. Additionally, large financial institutions and hedge funds can generate significant flows, affecting liquidity and driving directional moves. Recognizing the interplay between fundamental news and technical signals enhances your ability to anticipate and react to market shifts.

Applying Exchange Rate Quotes in Investment Decisions

Accurate interpretation of quotes empowers both speculative traders and long-term diversification investors. Speculators aim to profit from short-term swings by buying undervalued currencies and selling overvalued ones. They set stop-loss and take-profit orders in pips, carefully calculating position sizes to manage risk. Risk management is crucial: using excessive leverage can amplify gains but can just as easily magnify losses.

For portfolio managers, currency exposure can hedge against international downturns or capture yield differentials. Consider a US-based investor with European equity holdings: a weakening euro would erode returns when repatriated to dollars. To mitigate this, one might sell EUR/USD forward contracts, a form of hedging. Hedging costs include forward points, reflecting interest rate differentials between the two currencies over the contract period.

Retail traders can access currency markets through spot forex, options, futures, or exchange-traded funds (ETFs). Each vehicle has unique quote conventions and margin requirements. For instance, currency futures trade on standardized contract sizes with daily settlement, whereas options quote premiums in pips and implied volatility percentages. Familiarize yourself with the quotation method before placing an order to avoid surprises in performance or collateral demands.

- Spot Forex: Immediate settlement quotes, tight spreads, high liquidity.

- Currency Futures: Standardized quotes on regulated exchanges.

- Forex Options: Premiums quoted in pips, require volatility assessment.

- Currency ETFs: Share prices reflect currency pairs, trade like stocks.

Advanced Considerations for Experienced Traders

Seasoned traders delve into correlation matrices, studying how currency pairs move relative to each other and to other asset classes. For instance, commodity-linked currencies (AUD, CAD) often correlate with oil or metal prices. By analyzing these relationships, sophisticated players structure multi-leg strategies to exploit divergences or reinforce directional hypotheses. Monitoring intermarket diversification can yield unique arbitrage opportunities.

Another advanced topic is interest rate swaps and carry trades. A carry trade involves borrowing in a low-yield currency and investing in a high-yield one, profiting from the interest rate differential. However, adverse exchange rate movements can offset gains, so understanding forward points and implied interest in quotes is essential. Interest rate swaps quote fixed versus floating rates, and their valuation relies heavily on accurate currency pricing and credit considerations.

Algorithmic and high-frequency trading (HFT) strategies exploit micro-movements in exchange rate quotes. These systems parse streaming quotes in nanoseconds, searching for momentary inefficiencies. While beyond the scope of most retail setups, appreciating the speed and precision of such models underscores the importance of reliable data feeds and low-latency execution. Even manual traders benefit from real-time news services and robust platforms to stay competitive.

Ultimately, mastering exchange rate quotes blends theoretical knowledge with practical experience. By internalizing the meaning behind each numeric value, understanding the drivers of currency fluctuations, and applying structured risk controls, you can navigate the forex market with confidence. Continue refining your skills, monitor evolving market conditions, and remain disciplined in approach to achieve long-term success.