How to Use Multiple Time Frame Analysis in Forex

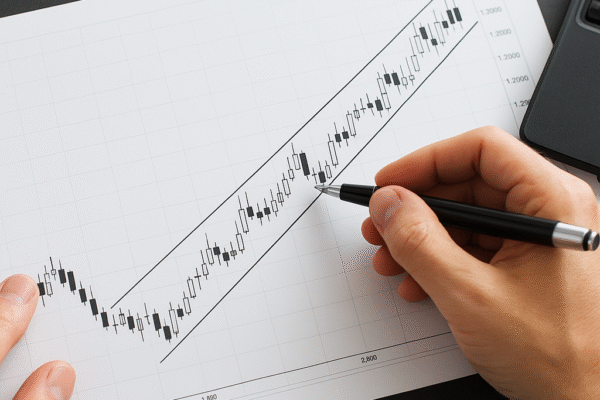

Mastering the art of forex trading requires more than just understanding currency pairs and economic indicators. By employing multiple timeframe analysis, traders can gain a clearer perspective on market dynamics, identify key trends, and refine their entry and exit strategies. This method helps bridge the gap between short-term noise and long-term momentum, ultimately improving decision-making…