The Benefits of Practicing with a Forex Demo Account

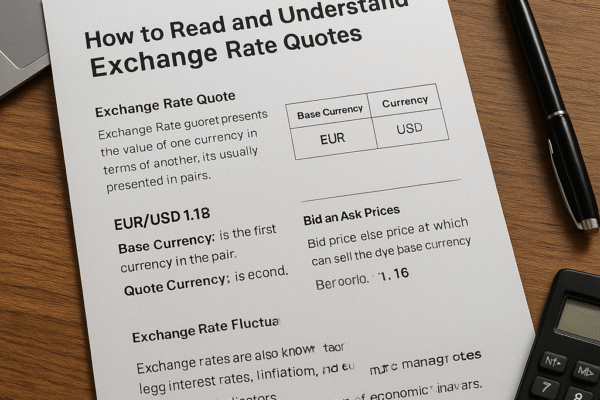

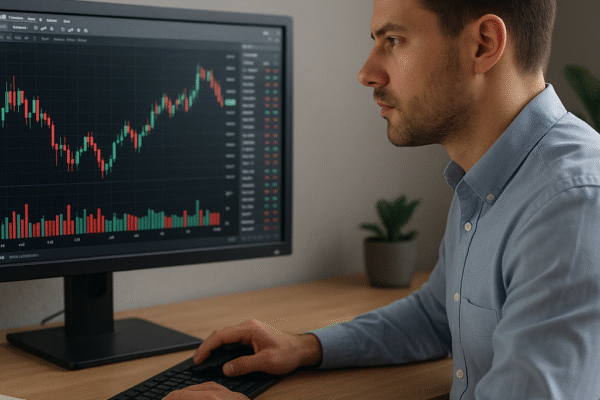

Stepping into the dynamic world of currency markets without risking real capital is a crucial step for aspiring traders. A Forex demo account offers a virtual playground where investors can learn how to handle price movements, test different approaches, and refine their overall market understanding. By leveraging this free practice environment, participants can gain valuable…