The Pros and Cons of Forex Trading for Long-Term Investors

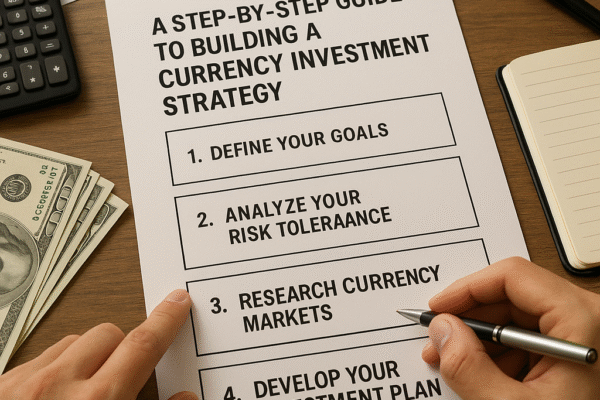

The global foreign exchange market offers a unique environment for those seeking to capitalize on currency movements over extended horizons. Long-term investors can find both opportunity and challenge in this vast arena, where shifts in interest rates, fiscal policy, and geopolitical events drive constant recalibration of values. Understanding the intricate mechanics and developing a sound…